AR/VR has become a two-speed market, with mobile AR set to have over twice the installed base at launch in 2017 than the entire AR/VR headset market by 2021, says Digi-Capital’s Tim Merel.

Apple ARKit, Google ARCore and Facebook Camera Effects platforms could have 900 million installed base by the end of 2018, with their launch changing the trajectory of the whole market. AR/VR advisor Digi-Capital has now fundamentally revised the AR/VR market thesis, analysis and forecasts in its bellwether Augmented/Virtual Reality Report, Augmented Reality Report and Virtual Reality Report.

Key Findings

- Mobile AR dominates AR/VR for the foreseeable future

- Smartglasses remain the long-term future of AR/VR, but could take into the next decade to become a mass-consumer market

- VR’s market potential has been diminished by the emergence of mobile AR as a rival platform

- Premium VR might not accelerate until second-generation standalone (neither PC nor mobile tethered) VR headsets emerge in 2019/2020

- Mobile VR’s potential has been reduced due to phone makers and developers pivoting towards mobile AR

The combined impact is a significant upgrade for AR and a material downgrade for VR.

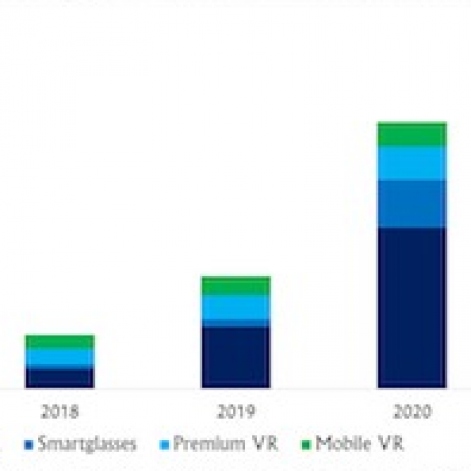

Mobile AR’s installed base could grow to over 3 billion by 2021, while smartglasses, premium VR and mobile VR combined might top 100 million in the same timeframe (so tens of millions for each platform individually). This makes mobile AR’s installed base more than 25x all AR/VR headsets long-term.

Where mobile AR dominates AR/VR installed base, it could account for only 2/3 of total market revenue by 2021. Mobile AR software’s economics are similar to the broader mobile market, where vast user bases with relatively low ARPU can deliver high growth and profitability.

Smartglasses, premium VR and (to a lesser extent) mobile VR benefit from significantly higher ARPU due to hardware sales, but much smaller installed bases limit their non-hardware revenue potential. Mobile AR could deliver 4.8x smartglasses, 1.3x premium VR and 1.5x mobile VR revenue in 2018, growing to 3.9x smartglasses, 4.8x premium VR and 9.6x mobile VR revenue by 2021.

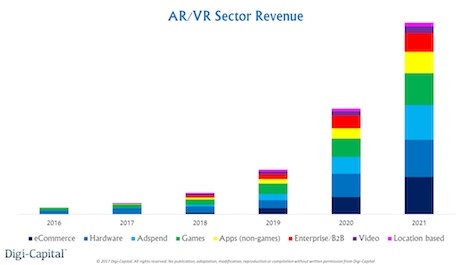

eCommerce could be the largest revenue stream across AR/VR by 2021 due to the scale of mobile AR’s installed base and increased conversion rates. Houzz has already delivered 11x sales conversion using mobile AR, so mobile AR eCommerce could further consolidate Amazon, eBay and Alibaba’s dominant positions.

Hardware sales (particularly consumer smartglasses and second-generation standalone premium VR headsets when they get here) are a close second, followed by adspend, games and non-games app revenues. Enterprise/B2B revenue will be driven primarily by AR, with video and location based (theme park) revenues at a much lower level.

Note: Telco data/voice revenues have been removed, as ARKit/ARCore’s ubiquity on standard smartphones/tablets has taken away telcos’ ability to implement premium mobile AR related pricing. Similarly, mobile AR hardware revenue has been excluded with Tango’s retirement and the iPhone X not including a rear-facing depth sensor.

With mobile AR’s geographic distribution broadly similar to current smartphone/tablet distribution, and VR’s distribution broadly similar to current games market distribution, AR/VR revenue could be dominated by Asia (particularly China, Japan and South Korea). This could see Asia roughly equal in size to North America and Europe combined. As smartglasses early consumer growth could come from mobile tethered smartglasses, its revenues might follow a similar geographic pattern.

Because of consumer smartglasses’ five consumer challenges (hero device, all-day battery life, cellular connectivity, app ecosystem, telco cross-subsidization), predominantly enterprise focused smartglasses sales could remain in the hundreds of thousands of units through 2019.

Digi-Capital’s long-held view since 2015 of Apple as the catalyst for AR proved to be correct this year. So its potential launch of mobile tethered smartglasses as an iPhone peripheral could be the catalyst for the consumer smartglasses market in the 2020 timeframe (followed by Samsung and other major phone makers).

You can read more in Digi-Capital’s completely revised Q4 2017 Augmented/Virtual Reality Report, Augmented Reality Report and Virtual Reality Report.